- Education & Events

- Advocacy

- Products & Services

- Membership

- Resources

- SDBANKER Magazine

- SDBA eNews

- SDBA eNews Archives

- Legislative Update/Bill Watch

- South Dakota Bank Directory

- Women in Banking

- Scenes of South Dakota Calendar*

- Holiday Signs

- Regulatory Report

- South Dakota Banking Code

- Record Retention Manual

- Advertising & Sponsorship Guide

- COVID-19 Resources

- Mental Health and Crisis Prevention

- About

|

SDBA and WBA Offering Course: Virtual Understanding Bank PerformanceRegister for the 2023 SDBA Ag Credit ConferenceThe South Dakota Bankers Association will present the 2023 Agricultural Credit Conference on July 19-20 in Pierre, S.D. This conference focuses on the unique needs of ag bankers and the desire for quality information and training to better serve their customers. Attendees will benefit from a day and a half of presentations from nationally recognized speakers, network with more than 125 banking peers and meet several exhibitors who offer products and services geared toward ag banking. New or experienced ag lenders, as well as CEOs, will all benefit from this conference. For more information or to register, click here. Registration Open for the 2023 SDBA Digital Innovations in Today's Banking Environment Conference

The SDBA Digital Innovations in Today’s Banking Environment Conference (formerly Technology Conference) will be held on August 29-30 at the Hilton Garden Inn Sioux Falls South in Sioux Falls. This conference is designed to provide support as you keep on top of technology trends, navigate the business of banking, and build and sustain your bank’s technology strategy—all to improve access and better serve your customers. The Digital Innovations in Today’s Banking Environment Conference will provide you with an opportunity to learn from industry experts, network with colleagues, and visit with exhibitors to see and experience the latest in products and services. There is an opportunity for business partners to exhibit at and sponsor the conference. For more information and to register, click here. SDBA Fraud Peer Group EstablishedWith all the recent fraudulent activity, the SDBA has been asked to establish a peer group of fraud-related personnel to share ideas, exchange thoughts, and network. There is no cost to participate in this group. This will initially be email-based, and, if the desire exists, potentially expand to Zoom/virtual or in-person, when allowed. If you would be interested in connecting, please email [email protected]. You will receive additional information once the group is established. ABA Strongly Opposes Re-Introduced Credit Card LegislationBy Rob Nichols, ABA President and CEO “We strongly oppose the damaging credit card legislation led today by Sen. Dick Durbin (D-IL), Sen. Roger Marshall (R-KS), Sen. J.D. Vance (R-OH), Sen. Peter Welch (D-VT), Rep. Lance Gooden (R-TX), Rep. Zoe Lofgren (D-CA), Rep. Jeff Van Drew (R-NJ), and Rep Tom Tiffany (R-WI). This is a regressive bill that takes from consumers, community financial institutions and small businesses and gives to the most profitable global retailers and biggest grocery chains. It’s particularly surprising to see Reps. Lofgren, Van Drew, and Tiffany partnering with Rep. Gooden to champion the top legislative priority of growing grocery conglomerates, rather than standing up for food shoppers. Likewise, it’s hard to understand why Sen. Vance is working with Sens. Durbin, Marshall and Welch to promote the profits of big box department stores and dominant online retailers in their plan to take away Ohioans’ credit card rewards. We’ve seen this movie before: the original Durbin Amendment eliminated debit card rewards, raised banking fees, and increased fraud costs all without lowering costs for consumers. At this time of high prices and security risks, America’s banks are focused on protecting consumers and we will vigorously oppose this misguided legislation.”

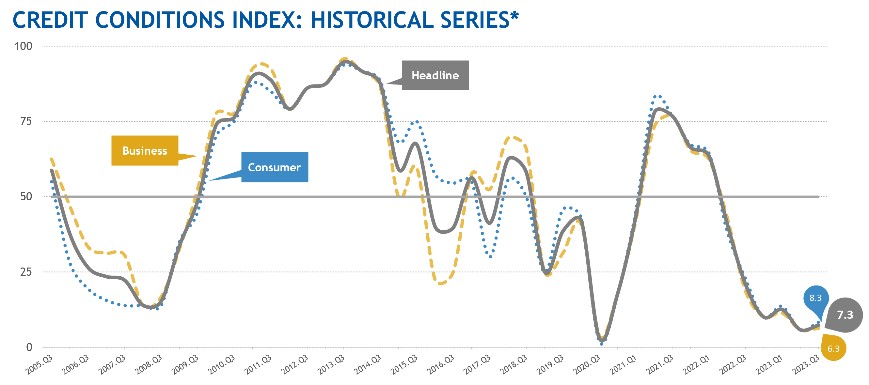

ABA Report: Bank Economists Expect Credit Conditions to Soften in the Second Half of the YearBank economists expect credit conditions to soften over the remainder of the year due to the economic headwinds faced by consumers and businesses, according to the American Bankers Association’s latest Credit Conditions Index released today.

The latest summary of ABA’s Credit Conditions Index examines a suite of indices derived from the quarterly outlook for credit markets produced by ABA’s Economic Advisory Committee (EAC). The EAC includes chief economists from North America’s largest banks. Readings above 50 indicate that, on net, bank economists expect business and household credit conditions to improve, while readings below 50 indicate an expected deterioration. According to the Q3 2023 report, most EAC economists continue to believe that credit quality and availability will weaken over the next six months, and no member of the Committee expects either metric to improve this year. While credit quality and availability have been remarkably resilient since the onset of the pandemic, recent index readings foretell softening credit conditions for both consumers and businesses. In response, EAC members expect that lenders will grow more cautious, particularly given elevated interest rates. “ABA’s latest Credit Conditions Index anticipates that lenders are preparing for weakening economic growth and increasing financial challenges for consumers and businesses as the year progresses,” said ABA Chief Economist Sayee Srinivasan. “At the same time, bank economists expect inflation to continue to ease, reducing the need for additional Fed rate hikes, and that underlying strength in the labor market will provide a buffer for consumers and businesses.” In the third quarter:

Read the full report with detailed charts and a discussion of the broader economic context.

CISA News: The FBI Could Help Retrieve Your Data After a Ransomware AttackThis article gives organizations guidance on what you should and should not do if your organization falls victim to a ransomware attack. Spoiler alert, the best message is do not pay the ransom!

|