- Education & Events

- Advocacy

- Products & Services

- Membership

- Resources

- SDBANKER Magazine

- SDBA eNews

- SDBA eNews Archives

- Legislative Update/Bill Watch

- South Dakota Bank Directory

- Women in Banking

- Scenes of South Dakota Calendar*

- Holiday Signs

- Regulatory Report

- South Dakota Banking Code

- Record Retention Manual

- Advertising & Sponsorship Guide

- COVID-19 Resources

- Mental Health and Crisis Prevention

- About

|

Register for the 2023 National School for Experienced Ag BankersSubmit Your Photos for a Chance to be Featured in the 2024 SDBA Calendar

To submit your photos, go to www.sdba.com/scenes-of-south-dakota-calendar. Submission deadline is July 31, 2023. All photos submitted will be judged and the top photos will be featured throughout the 2024 Scenes of South Dakota calendar. Questions, email [email protected] or contact Haley Juhnke at 605.224.1653. Save the Date: Digital Innovations in Today's Banking Environment Conference

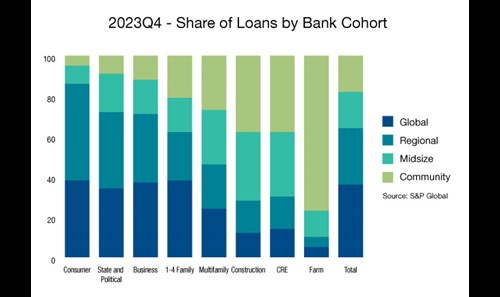

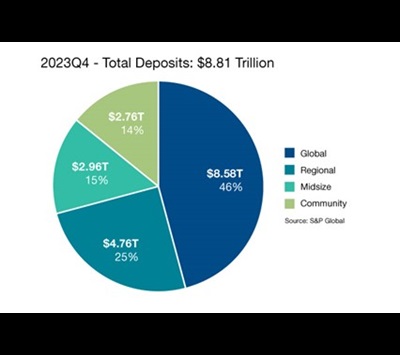

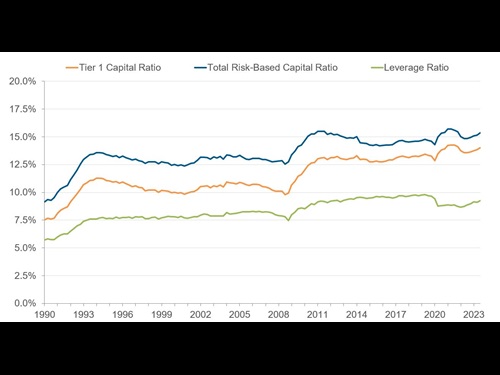

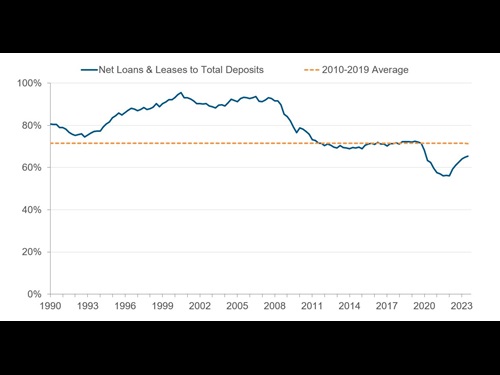

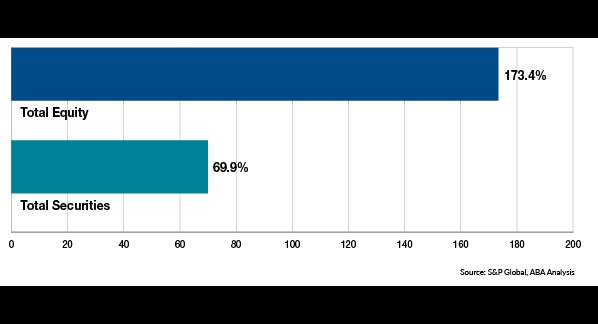

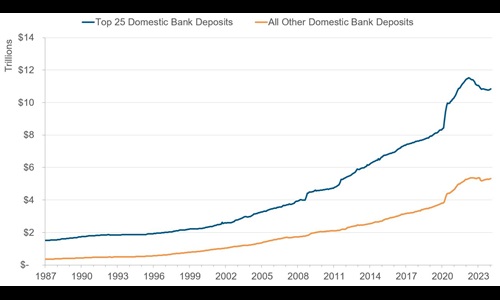

Mark your calendars! The SDBA will host the 2023 Digital Innovations in Today's Banking Environment Conference on Wednesday, August 30 in Sioux Falls, S.D. Stay tuned for more information to come! Free Webinar: Ways to Recognize and Combat Elder Financial ExploitationIn advance of World Elder Abuse Awareness Day, join ABA Foundation and the Department of Justice for a free webinar on recognizing behavioral and financial red flags on June 14, 2023, from 1:00-2:00 p.m. CT. Elder financial exploitation affects an estimated 10 to 20 percent of older adults and leads to billions of dollars in losses each year. These abuses have spiked over the past few years at alarming rates. Often, bankers are the first ones to notice suspicious activities and are well positioned to combat these crimes. Safe & Sound: America's Banks Remain Healthy and StrongWith 4,700 banks of all sizes, the U.S. has one of the deepest and most diverse banking systems in the world. The wide range of banks serving communities across the country continues to be a source of strength for our economy. Each bank has its own unique approach, capabilities, and strengths. Together, America's banks provide the fuel that drives the U.S. economy forward. Banks of All Sizes Make Loans That Drive America's EconomyTotal Deposits by Bank TypeThe U.S. banking marketplace is also highly competitive with community, midsize, regional and global systemically important banks (GSIBs) all vying for individual and business customers. See the many ways banks of all sizes serve their customers and communities. Overall Industry Remains Healthy and StrongAs the Federal Deposit Insurance Corporation’s latest Quarterly Banking Profile shows, the banking sector remains strong amid continued economic uncertainty. Below are charts that detail key indicators of the industry’s health. Capital LevelsCapital levels, one of the best ways to gauge bank health, are strong, with the Tier 1 risk-based capital ratio and Total risk-based capital ratio both more than 30 basis points above pre-pandemic levels (13.65% and 14.94%, respectively). The industry leverage ratio increased for the fourth consecutive quarter in Q4 2022, reaching 8.98% (+24 basis points year-over-year), and total bank equity capital remains 4.5% higher than its pre-pandemic level.LiquidityAggregate loan-to-deposit ratios, one of the tools to measure bank liquidity, remain low at 62.62%, still nearly 8.9 percentage points below pre-pandemic levels. Furthermore, the industry has strong levels of securities eligible for collateral at the new Bank Term Funding Program, which is an additional liquidity option now available to banks. Eligible securities make up 9.9% of total bank assets, up 2.1 percentage points from their pre-pandemic level.

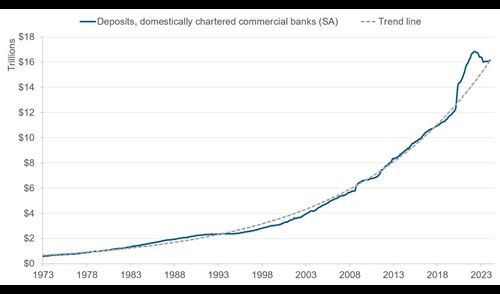

Deposit Levels are Returning to Normal

Banks saw a record flood of deposits during the pandemic as Americans moved their funds to the safety of banks. It’s not surprising that in the post pandemic period, deposits have returned to more normal levels. These charts show the history and recent trends in deposit flows.

SDBA Staff is Heading to Sioux Falls!The SDBA staff will be out of office through Wednesday, June 7 as we host the 2023 SDBA/NDBA Annual Convention in Sioux Falls! Many thanks to our generous business partners that help make this event possible. If you are planning to attend, we will see you there!

CISA News: Phishing Attacks Surge 356% Last YearNew technology like Artificial Intelligence and Machine Learning tools are allowing malicious actors to generate and automate social engineering and phishing attacks. - 363% increase in phone scam attacks - 161% increase in cloud storage attacks - 67.4% of all attacks were phishing - 83% increase in business email compromise attacks Are you training your employees to be aware of email phishing scams?

|

The South Dakota Bankers Association is creating a customized calendar from photographs of South Dakota submitted by South Dakota bankers, their family members and customers. These calendars are exclusive to SDBA member banks and make a great gift for your customers!

The South Dakota Bankers Association is creating a customized calendar from photographs of South Dakota submitted by South Dakota bankers, their family members and customers. These calendars are exclusive to SDBA member banks and make a great gift for your customers!